can you go to jail for not filing tax returns

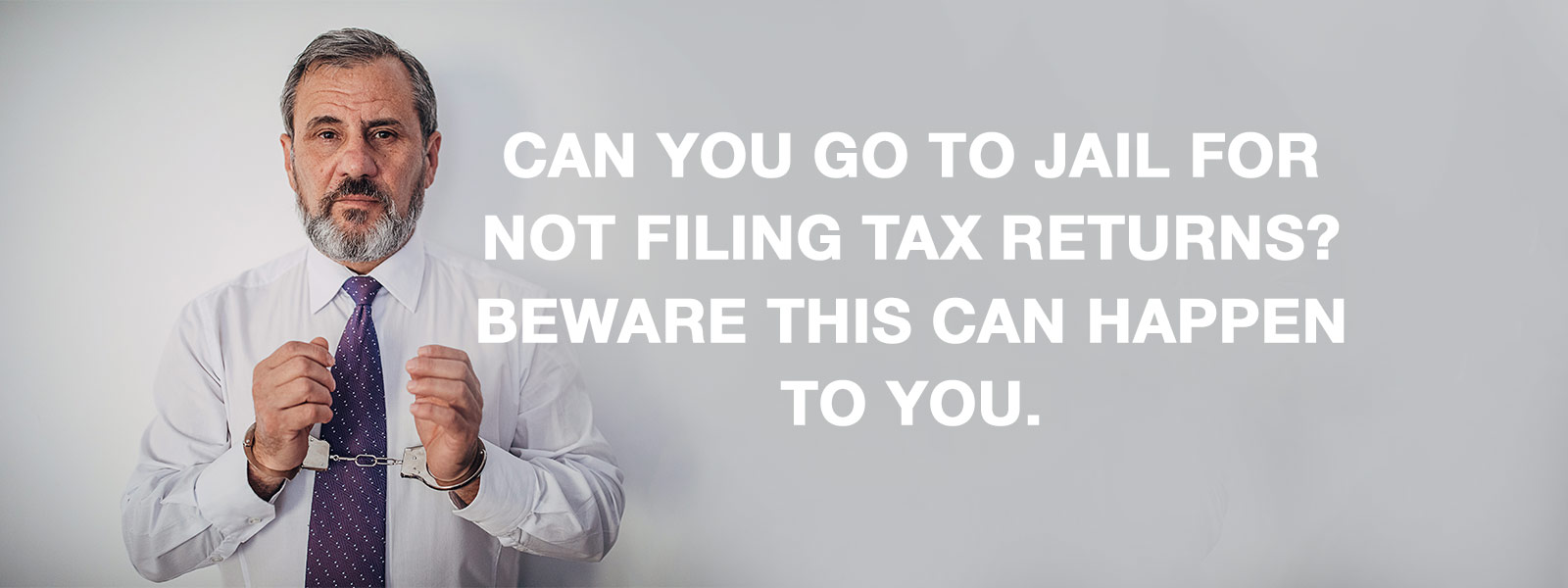

In addition to a prison term the US. Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen.

What To Do If Your Tax Refund Is Wrong

Even if the taxes do not belong to you you still could face jail time for.

. Further if you are caught helping someone evade paying taxes you can also be arrested and charged with this crime. Can you go to jail for not filing a tax return. Tax Fraud is a criminal offense.

What happens if you get caught not filing taxes. Are there any remedies. The following actions can lead to jail time for one to five years.

The short answer is maybe it depends on why youre not paying your taxes. By and large the most common penalties the IRS issues are fines and interest. Courts will charge you up to 250000 in fines.

If you had very low or no income last year and are not required to file you may wish. The penalty is usually 5 of the tax owed for each month or part of a month the return is late. Filing a fraudulent tax return can land you in the Big House as can helping someone else avoid filing taxes.

The maximum failure-to-file penalty is 25. Plus if you file more than 60 days late youll pay a minimum of 135 or 100 percent of the taxes you owe whichever is less. If you dont owe tax at the end of the year but had taxes withheld.

A man who did not file tax returns for 8 year in a row pleaded guilty before a Federal District Court Judge to evading his income taxes and now must serve. Beware this can happen to you. You would need to fill out Form 4868 Application for Automatic Extension of Time to File United.

A man who did not file tax returns for 8 year in a row pleaded guilty before a Federal District Court Judge to evading his income taxes and now must serve 57 months in jail. If you fail to file a tax return and arent. Can you go to jail for not filing a tax return.

If youre required to file a tax return and you dont file you will have committed a crime. If you didnt earn any income in the last tax year youre not obligated to file a tax return. The following actions can land you in jail for one to five years.

Penalty for Tax Evasion in California Tax evasion in California is punishable by up to one year in county jail or state prison as well. Any action taken to evade the assessment of a tax such as filing a fraudulent return can land you in prison for 5. How likely is it to go to jail for not filing taxes.

The maximum failure-to-file penalty is 25. If your return is more than 60 days late the minimum. However you can face jail time if you.

Whether a person would actually go to jail for not. The short answer to the question of whether you can go to jail for not paying taxes is yes. May 4 2022 Tax Compliance.

However the IRS also has a long time to try and collect taxes from you. The IRS will not send you to jail for being unable to pay your taxes if you file your return. Technically a person can go as long as they want not filing taxes.

Simply for filing a. It depends on the situation. What happens if I dont file taxes but dont owe.

Even if you arent required to file a return you still may want to. The extension allows you to file at a suitable time even after the tax deadline. The criminal penalties include up to one year in prison for each year you failed to file and fines up.

The penalty is usually 5 of the tax owed for each month or part of a month the return is late. Is not filing a tax return included in tax fraud. While there is generally a 10-year limit on collecting.

You can also land in jail for failing to file taxes expect a year behind. While the IRS can pursue charges against you beginning after that first year you fail to file. If you cannot afford to pay your taxes the IRS will not send you to jail.

Here S What Happens If You Don T File Your Taxes Bankrate

How To File Your Taxes If Your Spouse Is Incarcerated

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes Parade Entertainment Recipes Health Life Holidays

Can You Go To Jail For Not Filing Tax Returns Beware This Can Happen To You Tax Attorney Orange County Ca Kahn Tax Law

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Can You Go To Jail For Not Paying Taxes Our Attorney Explains

Is Jail A Possibility If You Fail To Pay Your Taxes Frost Law Maryland Tax Lawyer

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

How To Fill Out A Fafsa Without A Tax Return H R Block

Can I Go To Jail For Unfiled Taxes

What Happens If You Can T Pay Your Taxes Ramsey

What Are The Irs Penalties And Interest For Filing Taxes Late Cbs News

Investigating Tax Refund Fraud Fbi

This Is What Happens If You File Taxes Late Story Arrest Your Debt

Can I Go To Jail For Unfiled Taxes

What Really Happens When I Don T File For My Tax Return Incometax Tax Taxseason Money Finance Irs Taxevasion Tax Return Income Tax Taxact

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes Parade Entertainment Recipes Health Life Holidays

Can You Go To Jail For Not Paying Your Taxes Yes There S A Statute Of Limitations For Criminal Penalties After Six Years You Can T Go To Jail For Not Paying Taxes But